2023年云南会计继续教育报名入口

Title: A Guide to Continuing Education Exam Questions for Accountants in Yunnan

Introduction to Continuing Education for Accountants in Yunnan

Continuing education for accountants is essential for staying updated with the latest regulations, techniques, and best practices in the field. In Yunnan, like in many other regions, accountants are required to participate in continuing education programs and pass examinations to maintain their licenses. This guide aims to provide insight into the types of questions you might encounter in the continuing education exam for accountants in Yunnan.

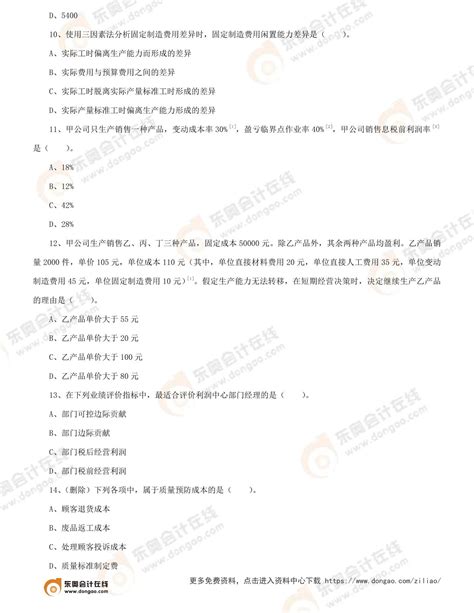

Section 1: Taxation

*Question 1:*

Explain the recent changes in tax laws affecting small businesses in Yunnan Province. Provide examples of how these changes impact tax planning strategies for small business owners.

*Guidance:*

This question assesses your understanding of current tax regulations and your ability to apply them to realworld scenarios. Make sure to include specific examples and discuss the implications for tax planning strategies.

Section 2: Financial Reporting

*Question 2:*

Discuss the differences between Chinese Accounting Standards (CAS) and International Financial Reporting Standards (IFRS). How do these differences impact financial reporting for multinational companies operating in Yunnan?

*Guidance:*

This question evaluates your knowledge of accounting standards and your ability to analyze their implications. Focus on both the similarities and differences between CAS and IFRS, and provide insights into their practical application for multinational corporations.

Section 3: Auditing

*Question 3:*

Outline the key steps involved in conducting a riskbased audit for a manufacturing company in Yunnan. How does the audit approach differ from traditional audit methods, and what are the benefits of adopting a riskbased approach?

*Guidance:*

This question tests your understanding of audit methodology and your ability to adapt it to different industries. Provide a comprehensive overview of the riskbased audit process, highlighting its advantages over traditional methods in terms of effectiveness and efficiency.

Section 4: Ethics and Professional Standards

*Question 4:*

Discuss the importance of professional ethics for accountants in Yunnan. Provide examples of ethical dilemmas that accountants may encounter in their professional practice and explain how to address them in accordance with relevant codes of conduct.

*Guidance:*

This question assesses your grasp of ethical principles and your ability to apply them in practice. Use reallife examples to illustrate ethical challenges faced by accountants and demonstrate your understanding of appropriate responses based on professional standards.

Conclusion

Continuing education exams for accountants in Yunnan cover a wide range of topics, including taxation, financial reporting, auditing, and ethics. By preparing thoroughly and understanding the key concepts and principles in each area, accountants can successfully navigate these exams and maintain their professional licenses. Remember to stay updated with the latest developments in the field to ensure compliance with regulatory requirements and provide highquality services to clients.

版权声明

本文仅代表作者观点,不代表百度立场。

本文系作者授权百度百家发表,未经许可,不得转载。